Penalty on late filing of Income Tax Return- Section 234F

Under Income Tax Act, 1961, every assessee is required to file his/her income tax return on or before the due date prescribed under section 139(1). Such due date is 31st July of every year but for the A.Y. 2021-22, the Government had extended the due date till 31st December 2021. As a responsible citizen, you are expected to file ITR online before the prescribed due date. If the assessee fails to file his/her income tax return even before the extended due date, he/she will be liable to penalty under section 234F of the Income Tax Act, 1961.

When was section 234F introduced?

Section 234F was introduced by the Finance Act 2017 which brought the concept of penalty or late fees on delayed ITR filing. Penalty under section 234F is applicable for Income Tax Return filing for the financial year 2017-18 and onwards. If a person who is compulsorily required to file ITR under the law fails to file ITR timely, then he shall be liable to pay penalty or late fees.

Initially, section 234F levied late fees or penalty up to Rs. 10,000 on delayed filing of ITR but Finance Act, 2021 has reduced the maximum amount of penalty to Rs. 5,000 now.

Analysis of Section 234F

|

Section 234F reads as follows: “(1) Without prejudice to the provisions of this Act, where a person required to furnish a return of income u/s 139, fails to do so within the time prescribed in sub-section (1) of the said section, he shall pay, by way of a fee, a sum of five thousand rupees: Provided that if the total income of the person does not exceed five lakh rupees, the fee payable under this section shall not exceed one thousand rupees.” |

So, it is important to check first whether you are required to furnish itr return u/s 139 of the Income Tax Act, 1961. According to Section 139(1), For every company or a firm, ITR efiling is compulsorily irrespective of their total income. In other cases, the assessee is required to furnish ITR if their total income exceeds the maximum amount chargeable to income tax.

It means that if a company or a firm including LLP defaults in the timely filing of their ITR, they are liable to pay at least a minimum penalty or late fee of Rs. 1,000 even if their income is nil or in a loss.

What is the amount of penalty prescribed under section 234F?

Penalty under section 234F in case of company/firm/LLP

|

If total income is up to Rs. 5,00,000 |

If total income is more than Rs. 5,00,000 |

|

Penalty/ Late Fee: Rs. 1,000 |

Penalty/ Late Fee: Rs. 5,000 |

Penalty under section 234F in case of individual or HUF

|

For assessee having total income up to Rs. 2,50,000 |

For assessee having total income between Rs. 2,50,000 & Rs. 5,00,000 |

For assessees having total income above Rs. 5,00,000 |

|

Penalty or Late fee: - Nil |

Penalty or Late Fee: - Rs. 1,000 |

Penalty or Late Fee: Rs. 5,000 |

Note:

- In the case of the individual or HUF, no penalty or late fees under section 234F shall be chargeable where their total income does not exceed Rs. 2,50,000 as they are not liable for IT return filing under section 139(1) in such a case.

- The penalty will not be levied in such cases where ITR is filed before the due date but e-verification is done after the due date.

- It is also important to note that the assessee is also liable to pay interest under section 234A in addition to penalty u/s 234F on late filing of ITR.

Can late fees under section 234F be waived?

No, late fee under section 234F is compulsory in case of delayed ITR filing. It cannot be waived off in any case.

How can we avoid late fees under section 234F?

There is only one way to avoid late fees under section 234F i.e. timely filing of ITR on or before the due date.

How to pay late fees under section 234F?

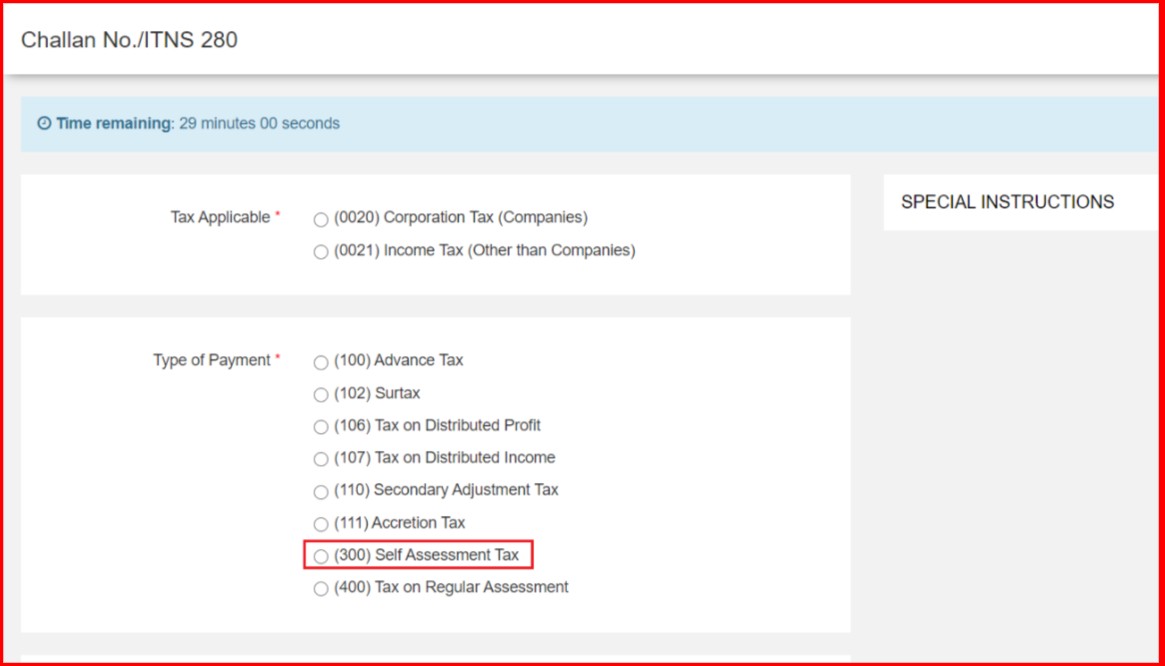

The taxpayer should use Challan No. 280 for paying late fees:

- In Challan No. 280, Select type of payment as “Self-Assessment Tax (300)”

- In Details of Payments, Fill the late fee amount under the column “Others”

The late fee can be paid using net banking or using a debit card. On successful payment, you can download a copy of the challan which shows the BSR code, date of payment, and challan number. Please don’t forget to fill in details of tax paid in the ITR for making a valid claim of tax and late fees paid by you.

Why should you file the return before the due date?

Every assessee should fill ITR online on or before the due date of furnishing ITR. The simple reason is to avoid late fees under section 234F. Besides this, there are some other reasons as well. The second and most important reason is the carry forward of losses. If you have incurred losses and you want to carry forward those losses to next year, then it is very important for you that return is filed timely. So, file online income tax return timely to save penalty. The Income Tax Act, 1961 does not allow carry forward of losses in case of belated or delayed returns filed.

Disclaimer: The article is meant for informative purposes only. Readers are requested to act diligently and under consultation with any professional before applying the information contained in this article.