Filing Income Tax on an e-filing website is pretty straight-forward. In our last article we have discussed how to submit and calculate income tax returns online with a simple and easy-to-understand guide.

Today, we will discuss how to open encrypted ITR-V documents along with electronic verification code generation methods.

Keep reading this article ...!

What is ITR-V?

ITR-V in other words ‘Income Tax Return- Verification’. It is a single page form. There are five alternative methods for e-verification of ITR filing. It is a type of confidential document i.e. is encrypted and protected by password which is provided by the Income Tax Department as a proof of their e-filing. ITR-V applies to those who file the return without a digital signature.

Let's understand the process of getting ITR-V Acknowledgement and how to open with a password.

Steps to obtain ITR-V Acknowledgement

- Visit the Income Tax India E-Filing website and log in with credentials.

- Click on ‘View Returns/Forms’ options to check e-filed returns.

- Under ‘Select an option’ dropdown, choose ‘Income Tax Returns’ and click Submit.

- Click on the ‘Acknowledgement Number’ for ITR-V downloading.

- Click on ‘ITR-V/Acknowledgement’ to begin the download.

- Then, in a short time, the particular download will start automatically.

- For opening the downloaded file, you need a password.

Note: For opening the PDF file Adobe Acrobat Reader 8.0 or higher is required. Click here download Adobe Acrobat Reader

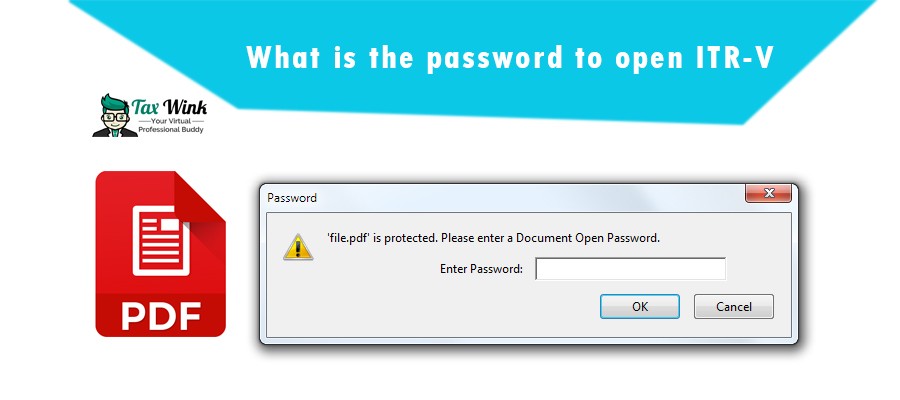

Password for Opening ITR Acknowledgement Form

The password to open ITR-V (acknowledgement document) is a combination of your PAN (in lowercase) and Date of Birth in DDMMYYYY format.

Let’s better understand with the example.

If the PAN is AAAPE2222A and Date of Birth is 28/12/1986, the password should be entered as aaape2222a28121986

Electronic Verification Code (EVC) Generation Methods

Well we know after filing an income tax return it’s mandatory to verify to make it valid in the eyes of ITD (Income Tax Department). Electronic Verification Code (EVC) is a 10-digit alphanumeric code, required to E-verify the tax return submitted. You have 120 days left from filing income tax online to verify, if not verified, the ITR submission confiscates as invalid.

Here are five straightforward methods to generate EVC to E-verify successfully:

1. Through Net Banking

- Login to your Net Banking Account

- Search for ‘Income Tax Filing’ on the home page

- Click on E-verify option, which will redirected to the website of the Income Tax department

- Click on ‘My Account’ Tab on the E-filing web page to generate EVC

- The EVC is then sent to your registered email ID and mobile number

- Now, go to the ‘e-verify option’ under the ‘My Account’ tab to verify your return

- Select the option ‘I have EVC already’

- Enter the EVC to e-verify your return

2. Via Aadhar OTP

- Link the AADHAR Card with your PAN, if not, at first.

- Now, visit the Income Tax e-filing website

- Go to ‘My Account’ tab and click on ‘e-verify return’

- Select the option- ‘I Would like to generate Aadhar OTP to e-verify my return’

- The OTP will be sent to the registered mobile number for AADHAR Card.

- Input the OTP received to E-verify your return within 10 minutes.

- Download the attachment after successful E-verification.

3. Visiting Bank ATM

- Swipe the Debit Card at a Bank ATM

- Click on the option of “Generate PIN for e-Filing.”

- EVC alphanumeric-type will be received on your registered mobile number.

- Visit the Income Tax Department e-filing website and select the option “e-verify” using Bank ATM.

- Enter the EVC to verify your ITR.

4. OTP Through Demat Account

- Go to Demat Account profile settings

- Enter the required details such as mobile number, email ID, and your depository name, i.e., NSDL or CDSL.

- Once the pre-validation process is successful then you can use your demat account to generate EVC.

- Go to the 'Generate EVC' option and select 'Generate EVC through Demat Account number.'

- Enter the EVC received by you on your registered mobile number to successfully verify your ITR.

5. Sending Signed Copy in 120 Days

- Send ITR-V documents via either ordinary post or speed post to the department.

- Address of CPC Bangalore for speed post: 'CPC, Post Box No - 1, Electronic City Post Office, Bangalore - 560100, Karnataka, India'.

- No other supportive documents are required with the ITR-V.

- You will receive notification of intimation via SMS or email ID once it is received by the tax department.

Note: You cannot courier ITR-V.

Read More: How to Check, E-Verify & Download ITR Status

Thanks for reading this article…!

Not filed yet? File your Income-tax return with TaxWink - fast process, accurate and simple, CA assessed guide at every step.