Corpus Donation by one trust to another trust- Income Tax Implications

Various non-profit organisations (NGO/NPO) make contributions in the form of corpus donation but they are confused about its income-tax treatment. The NGOs always enquire the manner they could get tax exemption under Income Tax Act in case of corpus donation. The Budget 2021 has brought some major amendments in the tax treatment of corpus donation but we will not discuss the same in this article and our discussion in this article will be restricted only to the above captioned topic “Whether one trust can make corpus donation to other trust or not”.

Question before us:

Can a trust make corpus donation to other trust?

Answer to this question is ‘yes’. Income Tax Act does not place any restrictions on trusts from making corpus donation to other trust.

This is not the actual issue. The question pertinent is:

Whether the corpus donation made by one trust to another trust will be treated as application of income for the purpose of Income Tax?

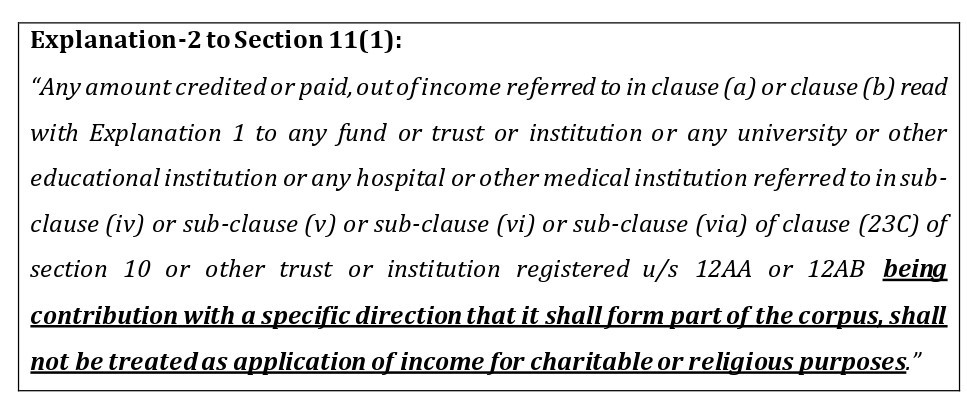

The Finance Act, 2017 amended section 11 of the Income Tax Act, 1961 with effect from A.Y. 2018-19 by inserting explanation-2 to section 11(1) of the Act as follows:

In simple words, if a religious/ charitable trust or institution pays, out of income derived from property held under trust, any contribution to any other trust or institution registered under section 12AA/ 12AB or under section 10(23C), with a specific direction that it shall form part of corpus of the trust or institution, then such corpus donations shall not be treated as application of income for charitable or religious purposes.

The above amendment was made by the Government with an intention to nullify the tax planning made by the NGOs. It is well-known to all of us that corpus donation received are not taxable under Income Tax Act (subject to amendment made by Finance Act 2021). Voluntary contributions (other than corpus) received by trusts are taxable in the Income Tax Return filed under the Act. However, if the trust or NGO applies such voluntary contributions received for charitable or religious purposes to specified extent, then such voluntary contributions received will not form part of the total income of trust/NGO for computation of income tax. Therefore, the trusts/NGOs were applying such voluntary contributions received by way of corpus donation to other trusts/NGOs registered u/s 12AA to fulfil the conditions for claiming tax exemption on such contributions. On the other hand, the donee trust need not pay tax on the contribution received while filing ITR efiling because the contribution received as corpus was not taxable at all. The same loophole was plugged by Finance Act, 2017.

We will try to understand the above with an example:

Suppose Trust ‘A’ registered u/s 12AA or 12AB receives Rs. 1 Lakh as income from property held under trust in the F.Y. 2021-22. As per the Income Tax provisions, the trust needs to apply at least 85% of such income towards charitable or religious purposes i.e. Rs. 85,000. The Trust could spend Rs. 10,000 actually for the charitable purposes. To fulfil condition of 85% application, the trust made corpus donation to other trust ‘B’ registered u/s 12AA or 12AB for Rs. 75,000. Thus, the total income of Trust ‘A’ was taken as ‘Nil’ as condition of 85% application is fulfilled. Further, Rs. 75,000 received by the donee trust ‘B’ was also not taxable being corpus donation. Thus, the income of Trust ‘A’ went untaxed all together without any actual utilisation for social purposes. This was not the actual intention of lawmakers. Finance Act, 2017 made amendment to stop such kind of tax planning. Now after amendment, Rs. 75,000 given by Trust ‘A’ to Trust ‘B’ as corpus donation will not be treated as an application for the purpose of charitable or religious activities. Thus, it will form part of taxable income of Trust ‘A’ and the Trust ‘A” will have to pay income tax thereon.

Disclaimer: These are the personal views of the author and are for informative purposes only. Readers are requested to take due consultation of any expert before relying on the above content. ‘Taxwink’ is not responsible for any loss or damage caused to any person on the basis for reliance upon this content.

About Author: The Author is CA Naveen Goyal who is a Chartered Accountant with experience of more than 15 years in the field of Income Tax, International Taxation and Indirect Tax (GST). You may reach him at email: admin@taxwink.com or call him at 09660930417.